What Percentage Is Nebraska State Income Tax . Nebraska also has a 5.50 percent state sales tax rate and an average combined state and. Nebraska's 2024 income tax ranges from 2.46% to 6.64%. Use our income tax calculator to find out what your take home pay will be in nebraska for the tax year. This is your nebraska income tax. The first deduction that all taxpayers face is fica taxes. Nebraska has a graduated corporate income tax, with rates ranging from 5.58 percent to 5.84 percent. This page has the latest nebraska brackets and tax rates, plus a nebraska income tax calculator. (enter on line 15, form 1040n; Nebraska, like most states, also deducts money to pay state income taxes. 100 rows today, nebraska’s income tax rates range from 2.46% to 6.64%, with a number of deductions and credits that lower the overall tax burden for many taxpayers. Enter your details to estimate your salary.

from taxfoundation.org

This is your nebraska income tax. (enter on line 15, form 1040n; This page has the latest nebraska brackets and tax rates, plus a nebraska income tax calculator. 100 rows today, nebraska’s income tax rates range from 2.46% to 6.64%, with a number of deductions and credits that lower the overall tax burden for many taxpayers. Use our income tax calculator to find out what your take home pay will be in nebraska for the tax year. Nebraska also has a 5.50 percent state sales tax rate and an average combined state and. Nebraska's 2024 income tax ranges from 2.46% to 6.64%. The first deduction that all taxpayers face is fica taxes. Enter your details to estimate your salary. Nebraska has a graduated corporate income tax, with rates ranging from 5.58 percent to 5.84 percent.

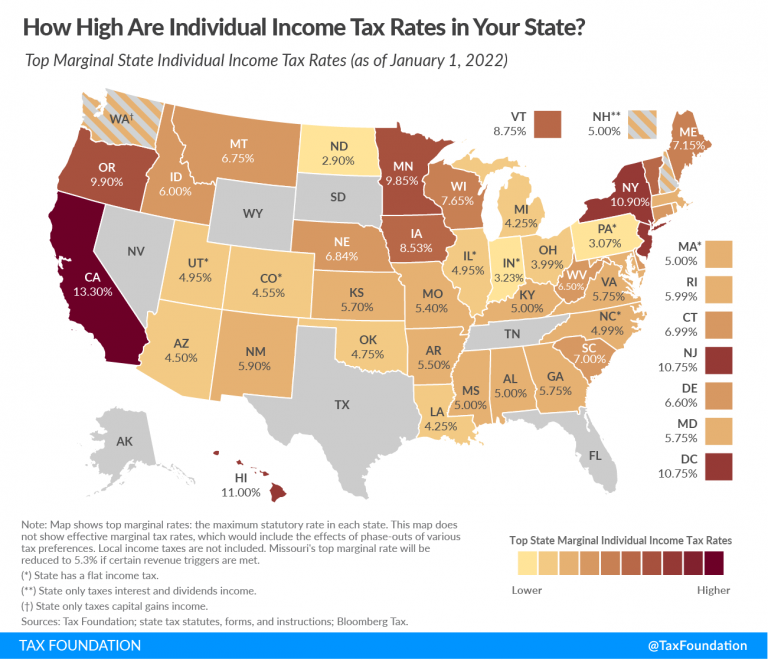

State Individual Tax Rates and Brackets Tax Foundation

What Percentage Is Nebraska State Income Tax Use our income tax calculator to find out what your take home pay will be in nebraska for the tax year. This page has the latest nebraska brackets and tax rates, plus a nebraska income tax calculator. This is your nebraska income tax. Nebraska's 2024 income tax ranges from 2.46% to 6.64%. Enter your details to estimate your salary. (enter on line 15, form 1040n; Nebraska has a graduated corporate income tax, with rates ranging from 5.58 percent to 5.84 percent. The first deduction that all taxpayers face is fica taxes. 100 rows today, nebraska’s income tax rates range from 2.46% to 6.64%, with a number of deductions and credits that lower the overall tax burden for many taxpayers. Nebraska also has a 5.50 percent state sales tax rate and an average combined state and. Nebraska, like most states, also deducts money to pay state income taxes. Use our income tax calculator to find out what your take home pay will be in nebraska for the tax year.

From www.mortgagerater.com

Nebraska Tax Rates Explained What Percentage Is Nebraska State Income Tax 100 rows today, nebraska’s income tax rates range from 2.46% to 6.64%, with a number of deductions and credits that lower the overall tax burden for many taxpayers. Nebraska's 2024 income tax ranges from 2.46% to 6.64%. Nebraska also has a 5.50 percent state sales tax rate and an average combined state and. Nebraska has a graduated corporate income tax,. What Percentage Is Nebraska State Income Tax.

From nebraskaexaminer.com

Nebraska's tax system is 'upside down,' report says, with higher What Percentage Is Nebraska State Income Tax (enter on line 15, form 1040n; Nebraska's 2024 income tax ranges from 2.46% to 6.64%. The first deduction that all taxpayers face is fica taxes. 100 rows today, nebraska’s income tax rates range from 2.46% to 6.64%, with a number of deductions and credits that lower the overall tax burden for many taxpayers. This page has the latest nebraska brackets. What Percentage Is Nebraska State Income Tax.

From www.dochub.com

1040n Fill out & sign online DocHub What Percentage Is Nebraska State Income Tax Enter your details to estimate your salary. (enter on line 15, form 1040n; Nebraska, like most states, also deducts money to pay state income taxes. Nebraska's 2024 income tax ranges from 2.46% to 6.64%. 100 rows today, nebraska’s income tax rates range from 2.46% to 6.64%, with a number of deductions and credits that lower the overall tax burden for. What Percentage Is Nebraska State Income Tax.

From www.mortgagerater.com

Nebraska Tax Rates Explained What Percentage Is Nebraska State Income Tax 100 rows today, nebraska’s income tax rates range from 2.46% to 6.64%, with a number of deductions and credits that lower the overall tax burden for many taxpayers. Nebraska's 2024 income tax ranges from 2.46% to 6.64%. This is your nebraska income tax. The first deduction that all taxpayers face is fica taxes. (enter on line 15, form 1040n; Nebraska. What Percentage Is Nebraska State Income Tax.

From www.pinterest.com

Nebraska state and local taxburden has increased 91 between FY 1950 What Percentage Is Nebraska State Income Tax Nebraska has a graduated corporate income tax, with rates ranging from 5.58 percent to 5.84 percent. This page has the latest nebraska brackets and tax rates, plus a nebraska income tax calculator. The first deduction that all taxpayers face is fica taxes. 100 rows today, nebraska’s income tax rates range from 2.46% to 6.64%, with a number of deductions and. What Percentage Is Nebraska State Income Tax.

From hbecpa.com

Nebraska Introduces PTET Law and Lowers Tax Rates HBE What Percentage Is Nebraska State Income Tax (enter on line 15, form 1040n; Nebraska's 2024 income tax ranges from 2.46% to 6.64%. This is your nebraska income tax. The first deduction that all taxpayers face is fica taxes. 100 rows today, nebraska’s income tax rates range from 2.46% to 6.64%, with a number of deductions and credits that lower the overall tax burden for many taxpayers. Nebraska. What Percentage Is Nebraska State Income Tax.

From www.youtube.com

Form 1040N Nebraska Individual Tax Return YouTube What Percentage Is Nebraska State Income Tax This page has the latest nebraska brackets and tax rates, plus a nebraska income tax calculator. The first deduction that all taxpayers face is fica taxes. Enter your details to estimate your salary. Nebraska has a graduated corporate income tax, with rates ranging from 5.58 percent to 5.84 percent. Nebraska, like most states, also deducts money to pay state income. What Percentage Is Nebraska State Income Tax.

From www.cloudseals.com

nebraska property tax rates by county What Percentage Is Nebraska State Income Tax The first deduction that all taxpayers face is fica taxes. This is your nebraska income tax. Use our income tax calculator to find out what your take home pay will be in nebraska for the tax year. 100 rows today, nebraska’s income tax rates range from 2.46% to 6.64%, with a number of deductions and credits that lower the overall. What Percentage Is Nebraska State Income Tax.

From tandiewkalie.pages.dev

Nebraska State Tax Form 2024 Darci Elonore What Percentage Is Nebraska State Income Tax Use our income tax calculator to find out what your take home pay will be in nebraska for the tax year. (enter on line 15, form 1040n; This page has the latest nebraska brackets and tax rates, plus a nebraska income tax calculator. The first deduction that all taxpayers face is fica taxes. Enter your details to estimate your salary.. What Percentage Is Nebraska State Income Tax.

From taxfoundation.org

A TwentyFirst Century Tax Code for Nebraska What Percentage Is Nebraska State Income Tax The first deduction that all taxpayers face is fica taxes. This is your nebraska income tax. Nebraska also has a 5.50 percent state sales tax rate and an average combined state and. Nebraska, like most states, also deducts money to pay state income taxes. Nebraska's 2024 income tax ranges from 2.46% to 6.64%. Enter your details to estimate your salary.. What Percentage Is Nebraska State Income Tax.

From statetaxesnteomo.blogspot.com

State Taxes State Taxes Nebraska What Percentage Is Nebraska State Income Tax The first deduction that all taxpayers face is fica taxes. Nebraska has a graduated corporate income tax, with rates ranging from 5.58 percent to 5.84 percent. Enter your details to estimate your salary. This is your nebraska income tax. This page has the latest nebraska brackets and tax rates, plus a nebraska income tax calculator. Nebraska's 2024 income tax ranges. What Percentage Is Nebraska State Income Tax.

From kariottawbonni.pages.dev

Nebraska Tax Rates 2024 Allys What Percentage Is Nebraska State Income Tax This is your nebraska income tax. The first deduction that all taxpayers face is fica taxes. Use our income tax calculator to find out what your take home pay will be in nebraska for the tax year. Nebraska, like most states, also deducts money to pay state income taxes. (enter on line 15, form 1040n; Enter your details to estimate. What Percentage Is Nebraska State Income Tax.

From www.zrivo.com

Nebraska State Tax 2023 2024 What Percentage Is Nebraska State Income Tax This page has the latest nebraska brackets and tax rates, plus a nebraska income tax calculator. Nebraska has a graduated corporate income tax, with rates ranging from 5.58 percent to 5.84 percent. Enter your details to estimate your salary. Nebraska also has a 5.50 percent state sales tax rate and an average combined state and. Nebraska, like most states, also. What Percentage Is Nebraska State Income Tax.

From www.youtube.com

Nebraska State Taxes Explained Your Comprehensive Guide YouTube What Percentage Is Nebraska State Income Tax (enter on line 15, form 1040n; Nebraska, like most states, also deducts money to pay state income taxes. Use our income tax calculator to find out what your take home pay will be in nebraska for the tax year. Nebraska also has a 5.50 percent state sales tax rate and an average combined state and. Enter your details to estimate. What Percentage Is Nebraska State Income Tax.

From www.zrivo.com

Nebraska Tax Brackets 2024 What Percentage Is Nebraska State Income Tax Nebraska's 2024 income tax ranges from 2.46% to 6.64%. (enter on line 15, form 1040n; Enter your details to estimate your salary. This page has the latest nebraska brackets and tax rates, plus a nebraska income tax calculator. 100 rows today, nebraska’s income tax rates range from 2.46% to 6.64%, with a number of deductions and credits that lower the. What Percentage Is Nebraska State Income Tax.

From www.formsbank.com

Nebraska Tax Calculation Schedule For Individual Tax 2013 What Percentage Is Nebraska State Income Tax Enter your details to estimate your salary. Nebraska's 2024 income tax ranges from 2.46% to 6.64%. Nebraska, like most states, also deducts money to pay state income taxes. The first deduction that all taxpayers face is fica taxes. This is your nebraska income tax. Nebraska has a graduated corporate income tax, with rates ranging from 5.58 percent to 5.84 percent.. What Percentage Is Nebraska State Income Tax.

From taxfoundation.org

Tax Modernization A Key to Economic Recovery and Growth in Nebraska What Percentage Is Nebraska State Income Tax Enter your details to estimate your salary. Nebraska has a graduated corporate income tax, with rates ranging from 5.58 percent to 5.84 percent. This page has the latest nebraska brackets and tax rates, plus a nebraska income tax calculator. Use our income tax calculator to find out what your take home pay will be in nebraska for the tax year.. What Percentage Is Nebraska State Income Tax.

From investguiding.com

Sources of Government Revenue in the United States (2023) What Percentage Is Nebraska State Income Tax Nebraska's 2024 income tax ranges from 2.46% to 6.64%. Enter your details to estimate your salary. 100 rows today, nebraska’s income tax rates range from 2.46% to 6.64%, with a number of deductions and credits that lower the overall tax burden for many taxpayers. This is your nebraska income tax. Nebraska, like most states, also deducts money to pay state. What Percentage Is Nebraska State Income Tax.